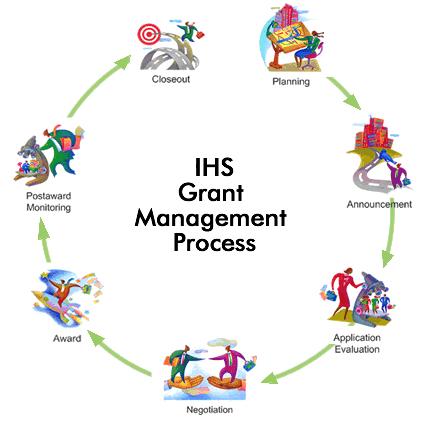

Effective Grants Management

Topics on this Page

- Part 1 - Notice of Award (Types, Terms and Conditions, Accessing GrantSolutions)

- Part 2 - Reporting Requirements (Deadlines, Financial &ersand; Programmatic, Drawdowns

- Part 3 - Changes (Scope, Personnel, Budget)

- Part 4 - Spending the Funds (Managing, Drawdowns)

- Part 5 - Grant Closeout (No cost extensions, unobligated funds, future funding)

- Part 6 - Grant Recipient Resources (GMS/Program Staff, Technical Assistance)

- Part 7 - Contacts

- Frequently Asked Questions

Part 1 - Notice of Award

Types of IHS Awards

Federal Financial Assistance is provided through:

- A legal instrument reflecting a relationship between the United States Government and a State, a local government, or other recipient when the principal purpose of the relationship is to transfer a thing of value to the State or local government or other recipient to carry out a public purpose of support or stimulation authorized by a law of the United States instead of acquiring (by purchase, lease, or barter) property or services for the direct benefit or use of the United States Government.

Two types of awards:

- Grants: A grant is one of the ways the government funds ideas and projects to provide public services, address critical needs and stimulate the economy.

- Cooperative Agreements: Unlike grants, substantial involvement is expected between the executive agency and the State, local government, or other recipient when carrying out the activity contemplated in the agreement.

What is the Notice of Award (NoA)?

- An IHS Notice of Award is the official document used to inform grant recipients (grantees) that their application for funding has been approved.

- It is the legal document issued notifying the recipient that an award has been granted and that funds may be requested from the Payment Management System.

- An automatic e-mail message from GrantSolutions is sent to the Authorizing Official and Program/Project Director (PD) listed in the grant application.

- The NoA can be downloaded from the GrantSolutions web site.

- NoAs are issued for the initial budget period and for each subsequent budget period in the approved project period.

The Notice of Award Details

- Grantee information

- Program Director and Authorizing Official

- Project Period and Budget Period start and end dates

- Approved funding amount

- Restrictions or issues the grantee has to address with their grant application

- Reporting Requirements

- Standard terms and conditions

- Single audit submission information

Standard Terms &ersand; Conditions

- Standard Terms and Conditions: Provides all the requirements of the award or sub-award, whether in statute or regulation. The terms and conditions are legally enforceable and may be referenced or specified in the full text of the Notice of Award and/or the Grants Policy Statement.

- Very Important! Always review your terms and conditions.

Restrictions

- What is a Restriction?

- A restriction is grant funding that cannot be drawn down in the Payment Management System pending resolution of an outstanding issue as determined by the GMO.

- Remarks section will include information on the amount that is restricted, reason the restriction is on the award, and how the grant recipient can have the restriction removed.

- Restrictions can be placed on part of the funding or the entire grant amount.

- The most common restrictions are:

- Restriction on Indirect costs due to an expired indirect cost rate agreement.

- Restriction on the entire award due to a delinquent financial audit report submission in to the Federal Audit Clearinghouse.

- Restriction on unallowable costs in the budget.

Part 2 - Reporting Requirements

Financial Reporting

- Submission of the Annual Federal Financial Report (SF-425)

IHS requires submission of an annual FFR (SF-425) no later than 90 days after the close of the budget period, unless otherwise specified in the terms and conditions in the Notice of Award (NoA). Failure to submit the complete and accurate FFR in a timely manner will result in the restriction of the recipient’s Payment Management System account and may delay funding and impact future funding. - Submission of the Final Federal Financial Report

Final FFRs are due 120 days after the end of the Project Period which is also referred to as the Period of Performance in PMS.

Program Reporting

- All IHS grant recipients must submit program progress reports. The frequency (ranging from quarterly, semiannually to annually) and program-specific instructions for preparation and submission of these reports will be identified in the terms and conditions on your NoA.

- Your NoA will contain instructions for submitting performance and progress reports.

- Failure to comply with this reporting requirement may result in the restriction of your account, delay of funds, or denial of future funding.

Single Audit Requirements

- The audit process is one of the Federal government’s major controls to provide assurance as to the compliance with Federal award requirements.

- Federal agencies use audits as an aid in determining whether resources have been safeguarded, funds have been expended properly, and desired program results have been achieved.

- Nonfederal entities that expend $750,000 or more under federal awards in a fiscal year must have a single audit performed in accordance with the Audit Requirements, 45 CFR 75.501, which implement the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 CFR 200.501. Reports on these audits must be submitted to the Federal Audit Clearinghouse (FAC) either within 30 days after receipt or nine months after the end of the fiscal year, whichever is earlier. The audit reports and a completed data collection form (SF-SAC) must be submitted electronically to the clearinghouse. FAC operates on behalf of the Office of Management and Budget (OMB).

For specific questions and information about the audit submission process, call the FAC toll-free number at 800-253-0696.

Part 3 - Changes

Post-Award Changes Requiring Prior Approval

- Change in the approved scope of work.

- Change in the Program Director and/or Program Coordinator, or a reduction of 25% or more in time and effort devoted to the project by the Program Director/Program Coordinator; or continuing the project for more than 3 months without the active direction of an approved Program Director and/or Program Coordinator.

- No Cost Extensions.

- Carryover of unobligated balances in excess of 25% of the total amount awarded for the current budget period.

- Budget Modification in excess of 25% of the total amount awarded for the current budget period.

Change in the Approved Scope of Work

- Scope of work means all services, work activities, and actions required of the grantee by the obligations of the award.

- A signed letter from the Authorized Representative requesting the change of scope. Included in this letter should be:

- A detailed explanation of the changes you are making,

- A reason why the changes are being made,

- How the changes will affect your current grant objectives and budget,

- How you plan to implement this new Best Practice by specific date,

- A budget,

- A budget justification.

Change in the Program Director and/or Program Coordinator

- Impacts and delays the project for timely completion.

- Name an interim until a permanent hire can be named.

- Request should be submitted in writing prior to implementation.

- Recipient must submit the following:

- Signed letter from the Authorizing Official that names the individual that will be over the Project Director role on the grant program.

- New Project Director’s CV or resume.

- New Project Director’s full work contact information (including work phone number and address).

- Request must be submitted via an amendment in GrantSolutions.

No Cost Extensions

- Final budget period is coming to an end.

- Extensions may be requested up to 12 months for the close-out of grant activities (extension is not for the purpose of using carryover funds).

- Grantee must submit:

- Cover letter (signed by the Authorizing Official) that provides the following information:

- A detailed reason why the no-cost extension (NCE) is needed.

- The length of time the NCE will be needed.

- Description of Activities (Format: MS-Word): Detailed description of what will be accomplished during the NCE period.

- Budget/Budget Justification (Format: MS-Word): If unobligated funds will be used during the NCE, then submit a detailed budget and budget justification as to how the funding will be used.

- Federal Financial Report (SF-425): Provide a financial report showing the unobligated funds that will be used during the NCE.

Carryover of Unobligated Balances

Carryover is a process through which unobligated funds remaining at the end of the budget period can be carried forward to the next budget period. Some grantees are allowed to carryover funds automatically if they have Expanded Authority for their grant program. For all others, grantees need to submit a carryover request to their Grants Management Specialists and Program Official.

- Carryover funds are to be used to enhance current year activities.

- Carryover should be requested as soon as new budget period’s award has been made.

- Carryover funds must be used in the same budget period it was approved.

- Do not proceed with carryover activities until you have received written approval, which will be in the form of a revised Notice of Award.

- Must be submitted via an amendment in GrantSolutions.

- The Carryover Request must be submitted through GrantSolutions and must include:

- Cover Letter signed by Authorizing Official that contains the following information:

- Amount of funds to be carried over.

- Explanation of why the unobligated balance occurred.

- Detailed description of activities/initiatives to be funded with the carryover funds.

- Scope of Work that embraces these activities/initiatives.

- Form SF-424A (Line Item Budget) – Do not combine the carryover budget with the award budget for the current grant year.

- Budget narrative for the carryover funds.

- Federal Financial Report (SF-425), showing unobligated balance of federal funds (Payment Management has to reflect the amount of funds requested for carryover).

Part 4 - Spending the Funds

Accessing the Payment Management System, Internal Control and Accountability

All organizations receiving federal awards should exercise efficient internal controls. The key individual responsible for submission of the Federal Financial Reports shall obtain access to the Payment Management System (PMS). The individual responsible for initiating the drawdown of funds should obtain access to the Payment Management System.

If the designated individual does not already have an account with PMS, they should contact PMS to request a User account. If you have questions about how to set up a PMS account for your organization, please contact the PMS Help Desk at PMSSupport@psc.hhs.gov, or 1-877-614-5533.

PMS access for Submission of Financial Reports, Drawdown of Funds and Adhoc Reports

- Guidance can also be found per the links noted – Payment Management System New User Access Request.

- Grant Recipient Training may be obtained through the Division of Payment Management.

- Upon completion of training, the awardee will be able to:

- Access PMS.

- Complete a payment request.

- Perform APEX inquiries.

- Run report requests.

- Complete the Federal Financial Report (FFR).

- Emphasis – Requests for training should go to GMS/PS and if directly related to systems (GrantSolutions, PMS help desk).

Part 5 - Grant Closeout

45 Code of Federal Regulations (CFR) 75.381

- An essential part of any federal grant program is a proper programmatic and financial closeout at the end of the grant’s period of performance.

- Closeout refers to the end of a grant’s lifecycle or period of performance.

- The closeout process for each IHS grant must be completed no later than 180 calendar days after receipt and acceptance of all required final reports from the recipient.

- The recipient organization must submit, no later than 90 days after the end of the period of performance, all final financial and Programmatic reports as required in the terms and conditions of the Federal award.

- The recipient organization must liquidate all obligations incurred under the Federal award no later than 90 calendar days after the end of the period of performance as specified in the terms and conditions of the Federal award.

What to submit for closeout

The recipient must submit the following:

- A final Federal Financial Report (FFR).

- Final Program Progress Report – Conduct a project programmatic review and submit your “Final Progress Report” according to the guidelines provided by your GMS in your closeout instructions or directly from the Program Office.

- A “Final Progress Report” is required for any IHS grant that is terminated or is at the end of the period of performance and ready for closeout.

- The Progress Report should be submitted via a Grant Note in GrantSolutions, and must include the outcomes (both positive and negative), evaluations and results on your accomplishments toward the programmatic goals and objectives for the entire period of performance for which you were funded.

Equipment Disposition

- Equipment is defined as an article of nonexpendable personal property whose original acquisition cost is $5,000 or more. Your organization shall use the equipment in the project for which it was acquired for as long as needed, whether or not the project or program continues to be supported by Federal funds and shall not encumber the property without approval of the IHS in accordance with 45 CFR 75.320. When no longer needed for the original program or project, the equipment may be used in other activities supported by the IHS with prior approval.

- Submit your SF-428 (Tangible Personal Property) report of equipment with a unit acquisition cost of $5,000 or more.

- The use of the following OMB Forms to request disposition and report equipment is required: SF-428C Disposition Request/Report &ersand; SF-428S “Supplemental Form” (Found on the IHS Grants Management web site: Forms .

- Supply Disposition – Submit your report of all unopened, unused supplies, if the total value of such unused supplies exceeds $5,000.

IMPORTANT! Retention and Access Requirements for Records

Retention requirements for records – Financial records, supporting documents, statistical records, and all other recipient organization records pertinent to a Federal award must be retained for a period of 3 years from the date of submission of the final expenditure report. 45 CFR 75.361 – When the recipient organization is notified in writing by the IHS of any grants violations, ongoing commitments or litigations, the entity will be required to extend their retention period.

Part 6 - Grant Recipient Resources

Division of Grants Management Staff

- Marsha Brookins, DGM Director/Chief Grants Management Officer

- Paul Gettys, Deputy Director

- Denise Clark, Grants Management Officer

- Paula Acevedo, Grants Management Specialist

- Pallop Chareonvootitam, Grants Management Specialist

- Andrew Diggs, Grants Management Specialist

- Sheila Miller, Grants Management Specialist

- Patience Musikikongo, Grants Management Specialist

- Cherron Smith, Grants Management Specialist

Current DGM staff directory can be found at Staff Directory.

Additional resources can be found at Grants Resources.

Part 7 - Contacts

- First contact - send a question to your assigned Grants Management Specialist or Program Specialist

- DGM@ihs.gov - general mailbox only routed to DGM Leadership

- GrantSolutions - the GrantSolutions Help Desk can be reached at Help@grantsolutions.gov, or 866-577-0771

- Payment Management System - several assistance tools and contacts can be found on the PMS Help Desk Page

Frequently Asked Questions

- Is Food Allowable?

Food is only allowable under the Special Diabetes Program for Indians (SDPI). For all other grant programs, food is unallowable. - Is a vehicle purchase allowable?

A - Vehicle purchases are evaluated on a case by case basis, and are determined on factors including (but not limited to):- Whether the grantee is able to lease a vehicle through GSA

- Cost and justification

- The grant activities that will be accomplished with the vehicle

- The frequency with which the vehicle will be used, and the grant staff who will be using it

- How the vehicle will be maintained, and the Tribe's plans for the vehicle once the grant Period of Performance ends

- How do I submit a change in Authorizing Official request?

The Authorizing Official (AO) role on a grant is chosen by Tribal leadership. Please upload the following into the Grant Notes for your grant:- A signed letter from the Tribal/Board Chairperson or updated Tribal Resolution that names the individual who will be taking over the role

- Please include the new AO's full work contact information

- Your Notice of Award will not be amended just to reflect a new AO

- Should the amounts reported on the annual FFR be cumulative?

Yes, the amounts on each FFR are cumulative from the Period of Performance Start Date to the Budget Period End Date for an annual FFR, or the Period of Performance End Date for the final FFR